LOGITECH Pop Mouse Emoji Tuşlu YB (Sarı) (910-006546) Fiyat ve Modelleri | Türkiye'nin En Ucuz Online Alışveriş Sitesi

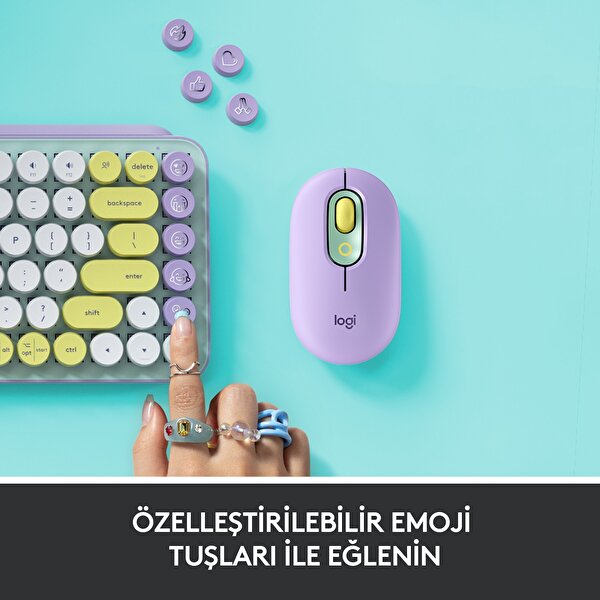

Logitech POP Keys Cosmos Kablosuz Mekanik Klananye Özelleştirilebilir Emoji Tuşlu, Dayanıklı Kompakt Tasarım, Bluetooth naneya USB Bağlantılı, Çoklu Cihaz Özellikli, Lila : Amazon.com.tr: Bilgisayar