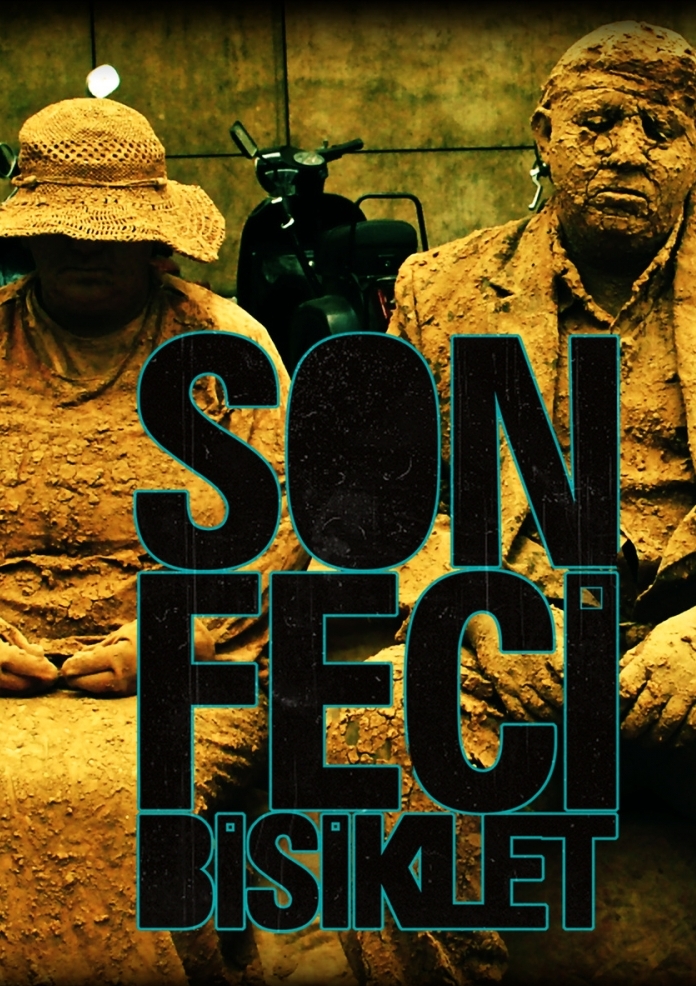

Son Feci Bisiklet Konseri Bileti, İstanbul Son Feci Bisiklet Konserleri, Takvimi, Programı - Fırsat Bu Fırsat

Son Feci Bisiklet Biletleri Antalya Holly Stone | iTicket.COM.TR - Türkiye'nin Bilet Satış Platformu

Müziğe Başka Kafalar Yaşatan Grup SON FECİ BİSİKLET'in Dinleyene De Başka Kafalar Yaşatacak 8 Şarkısı - Geekyapar!