Discord Bot - Discord Ultra Koruma + Moderasyon Bot | FivemTürk - Türkiye'nin ilk ve tek FiveM forum adresi

Tanıtım - Golyatsec Guard | Gelişmiş Güvenlik Botu (Resmi Discord Onaylı) | Minecraft Türk | Türkiye'nin En İyi Minecraft Forumu

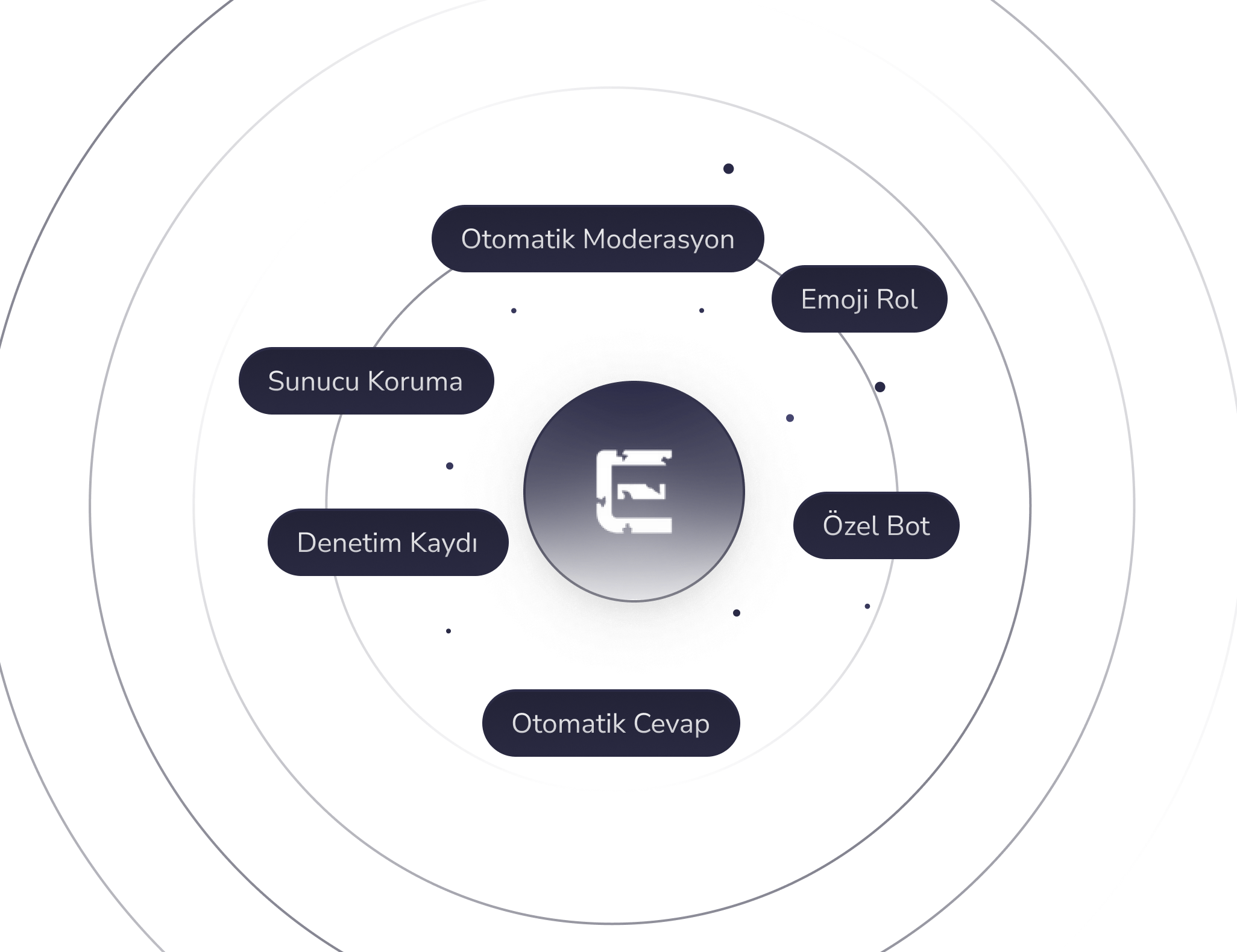

✨ GardBot Yeni Nesil Discord Koruma Botu İle Sunucularınızın Güvenliğini Sağlamaya Hazır Mısınız ? 🚀 | Oyuncular Şehri - Türk Oyuncu Forumu

Phoenix' Discord Botu! | Hazır Sunucu Kuran Moderasyon Botu | Otorol, Sayaç, Koruma ve Daha Fazlası - YouTube

✨ GardBot Yeni Nesil Discord Koruma Botu İle Sunucularınızın Güvenliğini Sağlamaya Hazır Mısınız ? 🚀 | Oyuncular Şehri - Türk Oyuncu Forumu