Fox Ford Focus 2 2005-2011 (3 Kol) Siyah Deri Direksiyon Kılıfı (FO-004) Fiyatı ile Özellikleri - Allesgo.com | Çarşı

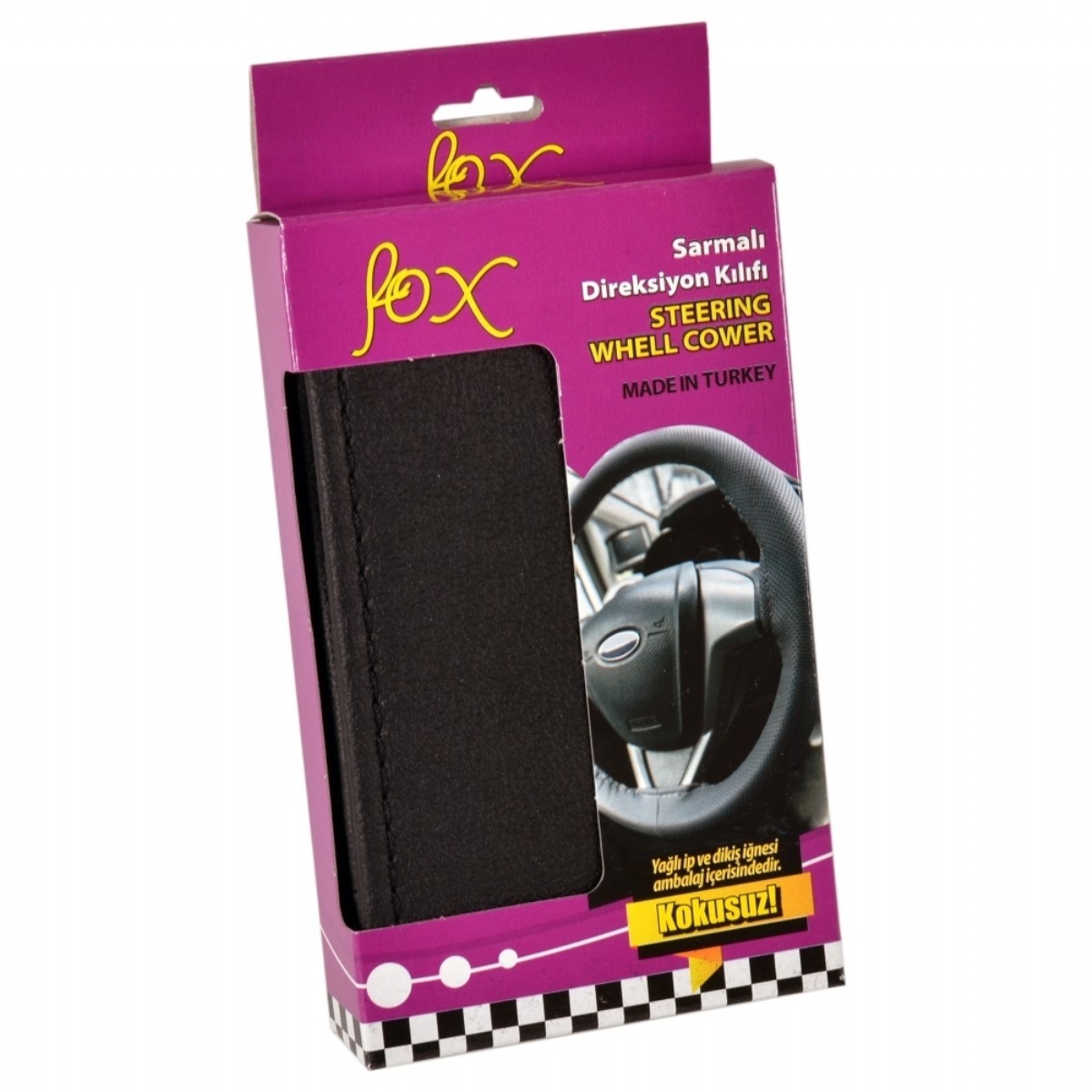

Fox D-121 Dikmeli Düz 38 Cm Siyah Direksiyon Kılıfı | Sarmalı-Dikmeli Kılıf | Direksiyon Aksesuarları | Marka11.com - Dikkat Çekmek İstiyorsan