Nike React Pegasus Trail 4 Gore-Tex Erkek Koşu Ayakkabısı DJ7926 Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

Adidas Ultraboost 22 Gore-Tex Erkek Koşu Ayakkabısı Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

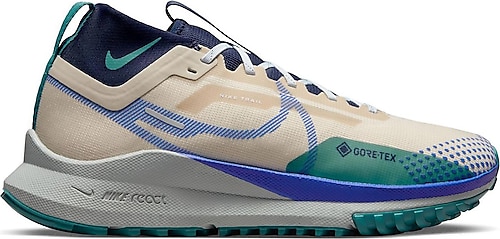

Nike React Pegasus Trail 4 Gore-tex Erkek Koşu Ayakkabı - DJ7926-001 Fiyatı, Özellikleri ve Yorumları