Derya Bedavacı Bedir indir, Derya Bedavacı Bedir mp3 indir dur, Derya Bedavacı Bedir mobil indir, Derya Bedavacı Bedir dinle, Bedir mp3 indir

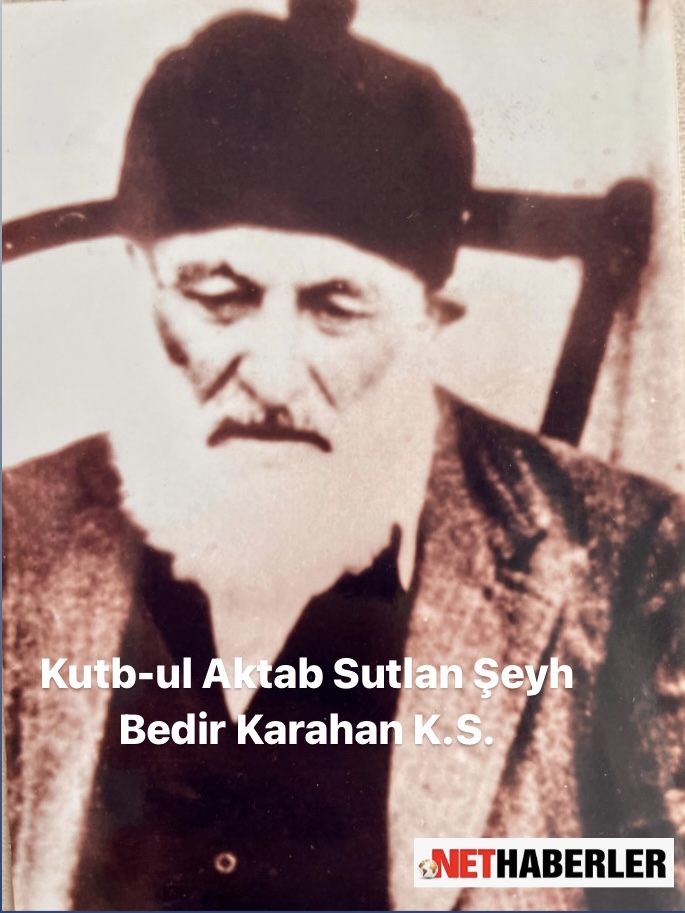

Şeyh Bedir Karahan (K.S.) Kimdir?, Hayatı ve Biyografisi... | Net Haberler - Haber, Haberler, Son Dakika Haberler, Güncel Haberler ve Gündem Haberleri

Ashab-ı Bedİr İsimleri ve Fazileti (DUA-013) - En Ucuz Kitap, eKitap (PDF, ePub, Mobi) Satın Al, İndir

Ashabı Bedir ve Şühedai Uhud İsimleri, Türkçe Cep Boy hızır yayın dağıtım, ashabı bedir ve uhud şehitleri, türkçe Dua Havas Elif Kitabevi

Mürşid-i Kamil Sultan Şeyh Bedir Karahan (K.S.) Kimdir?, Bedir Karahan Hayatı ve Bedir Karahan Biyografisi… | Net Haberler - Haber, Haberler, Son Dakika Haberler, Güncel Haberler ve Gündem Haberleri

İlahi Armağan, Fethur Rabbani Tercümesi, Abdulkadir Geylani, Büyük Boy Ciltli İlâhi Armağan Kitabı - Abdulkadir Geylan - Abdulkadir Akçiçek Tasavvuf Bedir Yayınevi

Kutb-ül Ektab (Mürşidi Kamil) Sultan Şeyh Bedir Karahan (K.S.) Kimdir?, Hayatı ve Biyografisi… | Net Haberler - Haber, Haberler, Son Dakika Haberler, Güncel Haberler ve Gündem Haberleri

Mürşid-i Kamil Şeyh Bedir Karahan (K.S.) | Net Haberler - Haber, Haberler, Son Dakika Haberler, Güncel Haberler ve Gündem Haberleri