Pepe Jeans Printed Women Round Neck Yellow T-Shirt - Buy Pepe Jeans Printed Women Round Neck Yellow T-Shirt Online at Best Prices in India | Flipkart.com

Light Blue Jeans with Black Long Sleeve T-shirt Casual Outfits For Women (2 ideas & outfits) | Lookastic

Ripped Jeans, Jeans and t-shirt, Easy outfit, Sneakers and Jeans | Dressy casual outfits, Ripped jeans outfit, Jeans outfit women

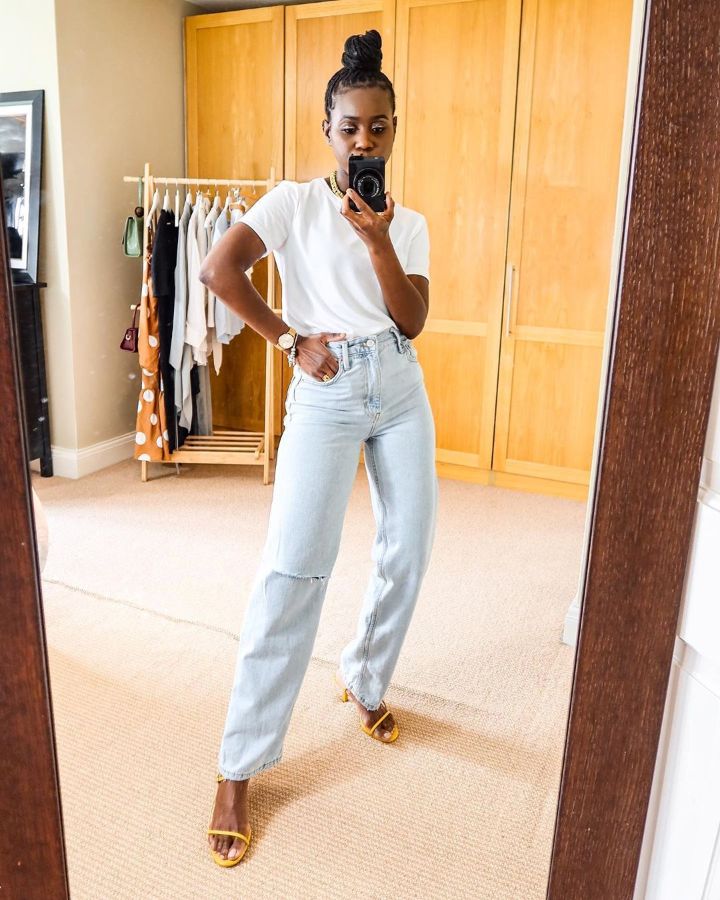

Best Affordable White T-shirts | The Best White Tees for Women Over 40 | Jeans outfit women, Tshirt outfits, White tee jeans

Kısa kollu t-shirt kadın Patchwork tüm maç Denim фcreativity бооdenim Denim Students еенсииstudents öğrenciler yaratıcılık tasarım yaz eğlence kore tarzı - AliExpress

10 Ways to Dress Up Your Favorite T-Shirt and Jeans | Jeans outfit women, Jeans and t shirt outfit, Shirt outfit women