Levemolo Üfleyici ızgara Soğutucu Fanı Fırın 12v Soğutucu Fan ızgara Fırın Parçası Fırın 12v Üfleme Fanı Fırın Aksesuarları Fırın Parçaları Fırın Dc Soğutma Fanı Pbt Barbekü : Amazon.com.tr: Mutfak

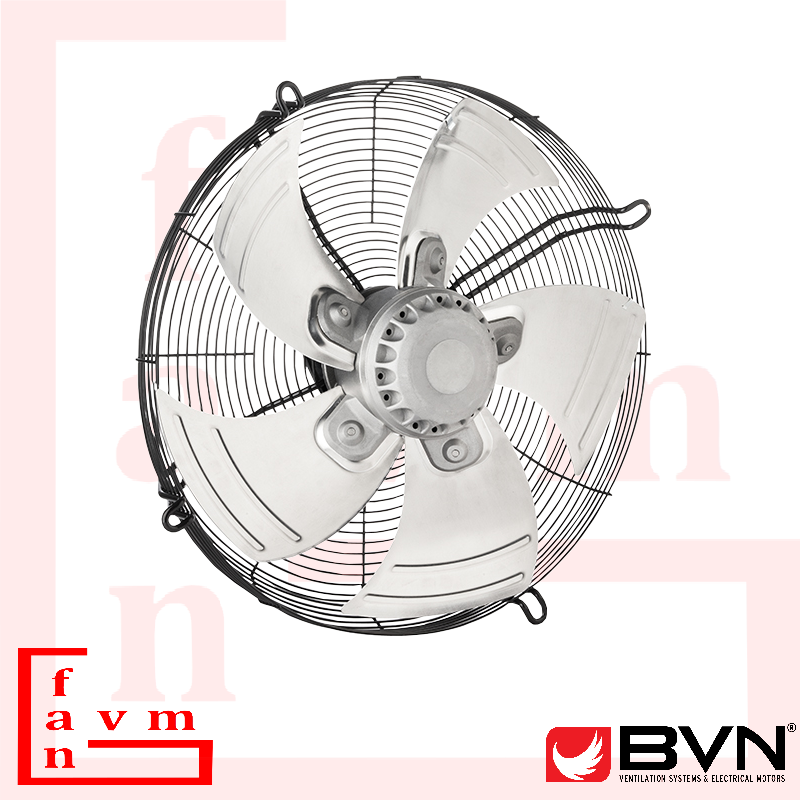

300mm Aksiyel Üfleme Fan Motoru RFC4-030-YLB - En Uygun Fiyat ve Özellikleri ile Yedepa.com'dan Satın Alın.

Coverzone Mini Usb Fan Standlı Koca Kafa Dizayn Portatif Tatilde Kampda Evde İş Yerinde Çantada Taşınabilir

Mini Fan, LED Işık Romantik Aşk Taşınabilir Mini El Fan Rüzgar Üfleme Yaz Soğutucu Mavi : Amazon.com.tr: Mutfak

PartyKindom Üfleyici Fırın Parçaları ızgara Soğutucu Fanı Fırın 12v Üfleme Fanı ızgara Fırın Parçası Fırın Aksesuarları Fırın 12v Soğutucu Fan Fırın Soğutma Fanı Barbekü Dc Paslanmaz Çelik : Amazon.com.tr: Mutfak

Coverzone Mini Usb Fan Standlı Koca Kafa Dizayn Portatif Taşınabilir 28cm Yüksekliği Ayarlanabilir 90° Oynar

EBERSPACHER AİRTRONİC VEBOSTA D2 ÜFLEME FAN MOTORU 24 VOLT ORJİNAL 252070992000 webasto kabin içi ısıtıcıları en ucuz vebosta fiyatları en uygun vebosta kayseri vebosta vebasto satış WEBASTO vebostacı

Coverzone Mini Usb Fan Standlı Koca Kafa Dizayn Portatif Taşınabilir 28cm Yüksekliği Ayarlanabilir 90° Oynar Başlık 3 Kademeli Üfleme YS-2231 (SARI) Fiyatları, Özellikleri ve Yorumları | En Ucuzu Akakçe

Küçük Fan Motoru Fiyatları-Pano Tipi Hava Üflemeli Fan Motoru Toptan Fiyat Listesi;220 volt elektrikle çalışan soğutucu fanı motoru dayanıklı profesyonel küçük kare tipi fan motoru imalatçıları kaliteli plastik malzemeden üretimli kare fan